Quick Summary: Affinity Programs

- Win-win-win model: Members save money, partners gain qualified customers, and your association earns commission on each transaction.

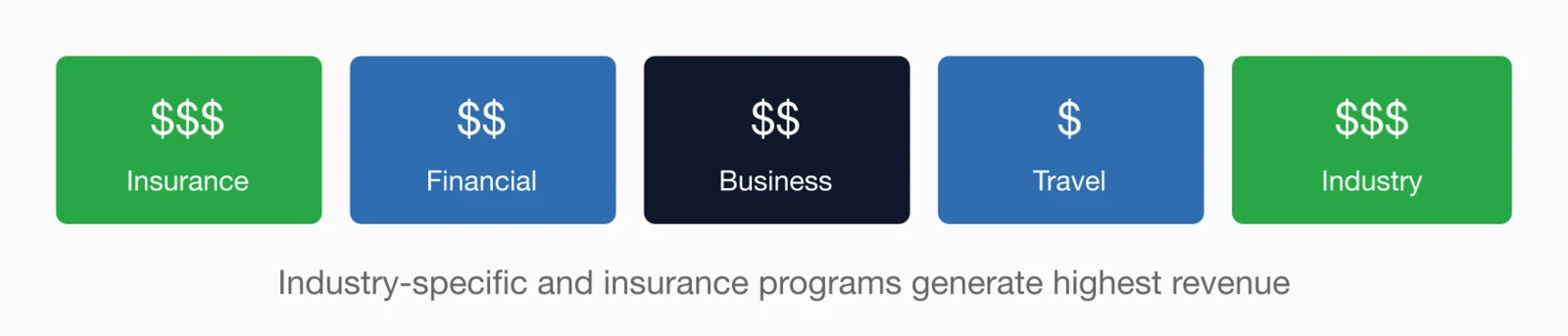

- Insurance generates highest revenue: Professional liability and group health programs deliver 5–15% of premiums in commission.

- Industry-specific benefits outperform: 10% off relevant tools beats 5% off random retailers—relevance drives usage.

- Quality over quantity: A curated list of 5–10 excellent benefits beats 50 mediocre ones in member trust and engagement.

- Passive revenue after launch: Well-established programs generate ongoing income with minimal ongoing maintenance.

Part of our alternative revenue streams guide

Member benefits partnerships leverage your collective buying power to negotiate exclusive discounts while earning commission on member purchases. This guide covers partner vetting, revenue models, and negotiation strategies for affinity programs.

The best affinity programs don't feel like revenue grabs. They feel like member benefits, because that's what they are. Members save money on products and services they were going to buy anyway, while your association earns commission on each transaction.

This guide covers how to build affinity partnerships that generate meaningful revenue while genuinely serving your members' needs. Trade associations with industry-specific vendor partnerships and membership nonprofits seeking sustainable revenue are particularly well-suited for affinity programs.

Why affinity programs work

The magic of affinity programs lies in their ability to create genuine value for everyone involved. Unlike advertising or sponsorships that benefit your association at the expense of member attention, affinity programs align incentives: members get better deals, partners get qualified customers, and you earn revenue for making the connection.

Value to members

- Exclusive discounts: Savings not available to the general public

- Vetted providers: Association endorsement signals quality

- Industry relevance: Products and services tailored to their profession

- Group buying power: Access to rates typically reserved for large organizations

- Convenience: One-stop access to multiple benefits

Value to partners

- Targeted audience: Direct access to qualified prospects

- Lower acquisition cost: Association endorsement reduces marketing expense

- Higher conversion rates: Trust transfer from association to partner

- Predictable customer base: Ongoing access to member population

- Brand alignment: Association with respected industry organization

Value to your association

Many associations treat affinity programs as part of a broader membership value strategy, using vetted partner benefits to strengthen retention while diversifying non-dues revenue.

- Passive revenue: Commission on member purchases with minimal ongoing effort

- Membership value: Tangible benefits that justify dues

- Retention driver: Members who use benefits are more likely to renew

- Non-dues diversification: Revenue stream independent of dues collection

Types of affinity programs

Associations can partner across many product and service categories, but the most successful programs focus on offerings that directly address your members' professional and personal needs. A small portfolio of highly relevant benefits will outperform a sprawling list of generic discounts every time.

Insurance programs (highest revenue)

Insurance partnerships typically generate the most significant affinity revenue:

- Professional liability insurance: Malpractice, E&O, errors and omissions

- Group health insurance: Medical, dental, vision for member businesses

- Business insurance: General liability, property, cyber liability

- Life and disability: Group term life, disability income

- Workers compensation: Pooled programs for member employers

Financial services

- Credit cards: Co-branded cards with rewards or cashback

- Banking services: Preferred rates on business accounts

- Payment processing: Discounted merchant services

- Retirement plans: 401(k) and pension administration

- Student loan refinancing: For professions with high education costs

Business services

- Office supplies: Discounted pricing from major suppliers

- Shipping: FedEx, UPS, USPS volume discounts

- Technology: Software, hardware, and cloud services

- Legal services: Discounted access to attorneys

- HR and payroll: Payroll processing and HR software

Travel and lifestyle

- Car rental: Discounted rates from major rental companies

- Hotels: Preferred rates at hotel chains

- Airlines: Discounted fares or bonus miles

- Cell phone plans: Group discounts on wireless service

Industry-specific benefits

The most valuable affinity programs address industry-specific needs:

- Equipment and supplies for your profession

- Industry-specific software tools

- Regulatory compliance services

- Continuing education providers

Prioritize relevance: Industry-specific benefits generate more engagement than generic discount programs. A 10% discount on industry-specific software is more valuable than 5% off at thousands of random retailers.

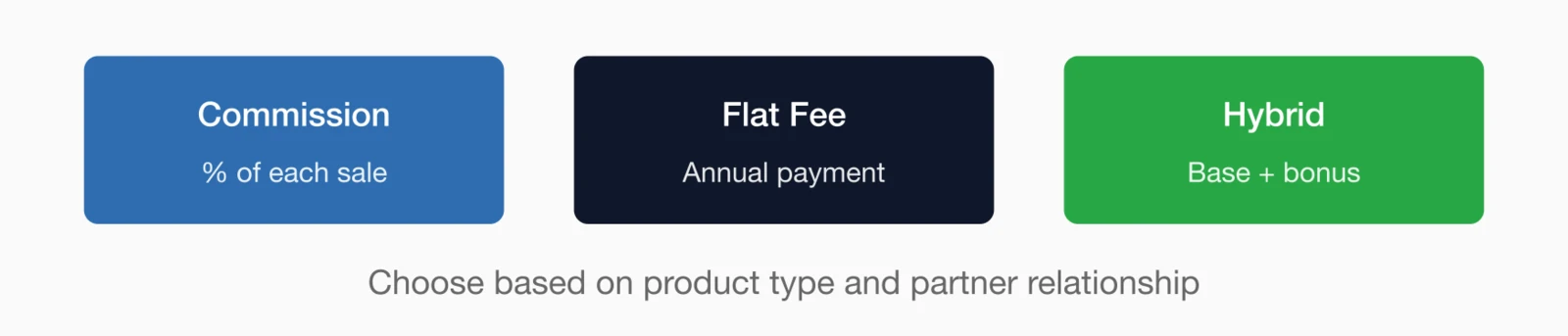

Revenue models

Affinity programs generate revenue through several models, and the best choice depends on the product category, your member base size, and the partner relationship. Understanding these options helps you negotiate agreements that work for your specific situation.

Commission/revenue share

You earn a percentage of each member purchase:

- Insurance: 5-15% of premium

- Credit cards: $50-$100 per approved application

- Financial services: 0.5-2% of assets under management

- Retail/supplies: 2-10% of purchases

Flat fee/licensing

Partner pays fixed annual fee for access to your members:

- Guaranteed revenue regardless of member participation

- Simpler to administer than tracking commissions

- Typical range: $5,000-$50,000 annually

- Often combined with minimum participation requirements

Hybrid models

Combination of guaranteed fee plus performance bonus:

- Base annual fee provides guaranteed income

- Commission on sales above threshold

- Aligns incentives between association and partner

Revenue potential examples

| Program Type | Revenue Model | Annual Revenue Potential |

|---|---|---|

| Group health insurance | 5-8% of premiums | $20,000-$200,000+ |

| Professional liability | 10-15% of premiums | $10,000-$100,000+ |

| Co-branded credit card | $75 per application | $5,000-$50,000 |

| Office supplies | 3-5% of purchases | $3,000-$30,000 |

| Car rental | Flat fee | $2,000-$10,000 |

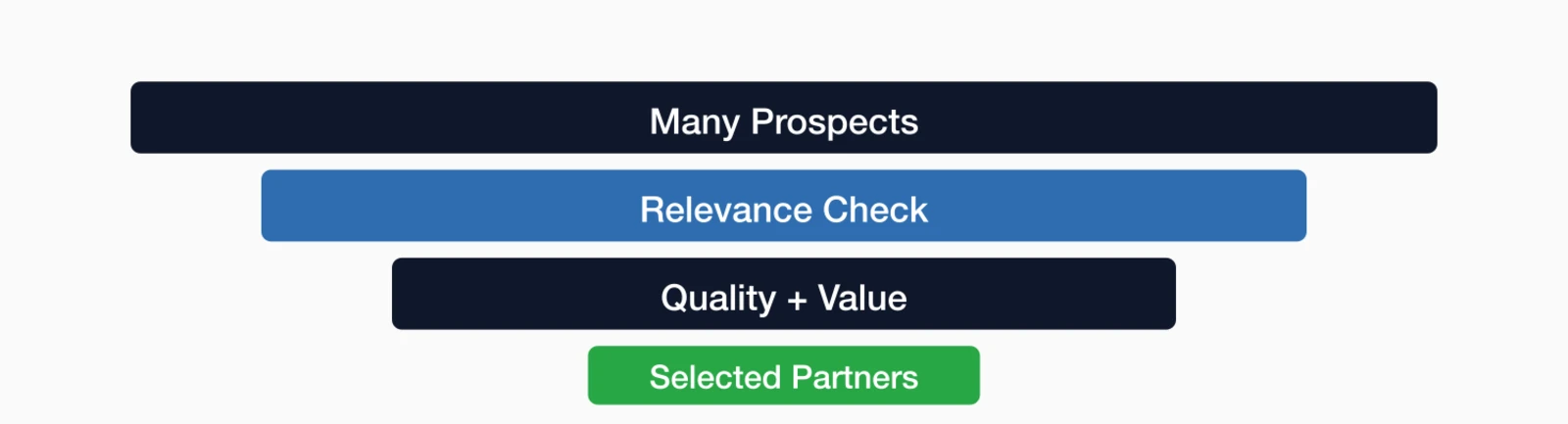

Finding the right partners

Partner selection can make or break your affinity program. A poorly chosen partner doesn't just underperform—it damages your reputation and wastes the member attention you've worked hard to earn. The vetting process is worth the investment.

Partner evaluation criteria

- Relevance: Does this product/service align with member needs?

- Quality: Is the partner reputable with strong customer service?

- Value: Is the discount meaningful and competitive?

- Exclusivity: Is this benefit unique to your members?

- Revenue potential: Will the partnership generate worthwhile income?

- Administrative burden: How much work will the partnership require?

Finding partner prospects

- Current sponsors and advertisers: Existing relationships with your audience

- Member employers and vendors: Companies already serving your members

- Industry suppliers: Product and service providers in your field

- Affinity program aggregators: Companies that package multiple benefits

- Other associations: Partners who work with similar organizations

Due diligence questions

- How long have you been in business?

- What associations do you currently partner with?

- Can you provide references from similar partnerships?

- What is your customer satisfaction rating?

- How do you handle member complaints?

- What reporting will you provide on member usage?

Negotiating agreements

Effective negotiation ensures fair value for your members and reasonable revenue for your association. Remember that you're bringing something valuable to the table: a trusted relationship with a targeted, qualified audience that partners couldn't easily reach on their own.

Key agreement terms

- Revenue/commission structure: Clear definition of how you get paid

- Reporting requirements: Regular updates on member participation and revenue

- Exclusivity: Whether you can offer competing products

- Marketing requirements: Partner's expectations for promotion

- Term and renewal: Contract length and renewal conditions

- Termination provisions: How either party can exit

- Liability and indemnification: Protection for your association

Negotiation leverage points

- Audience size: Larger membership commands better terms

- Audience quality: High-earning or high-spending members are more valuable

- Engagement level: Active, engaged members are more likely to participate

- Exclusivity value: Exclusive access to your members is worth more

- Competitive alternatives: Multiple potential partners improve negotiating position

Protect your brand: Never let partners use your logo or name without approval. Maintain control over all communications to your members and require approval for any marketing that mentions your association.

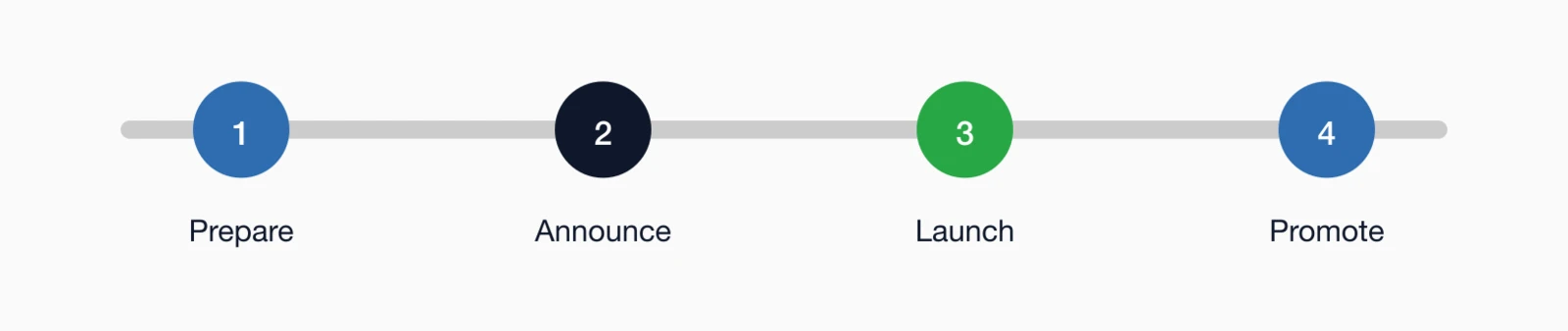

Launching programs

A strong launch sets the tone for member adoption. Even the best partnership will underperform if members don't know about it or find it confusing to access. Plan your launch as carefully as you planned the partnership itself.

Launch preparation

- Create dedicated landing page for each benefit

- Develop clear member-facing messaging

- Train staff to answer member questions

- Set up tracking to measure participation

- Coordinate launch timing with partner

Communication strategy

- Email announcement: Dedicated email introducing new benefit

- Newsletter feature: Regular coverage in member communications

- Website placement: Prominent member benefits section

- New member welcome: Include benefits in onboarding

- Social media: Promote savings opportunities

Making access easy

- Single sign-on from member portal when possible

- Clear instructions for accessing each benefit

- Unique member codes or links for tracking

- Mobile-friendly access

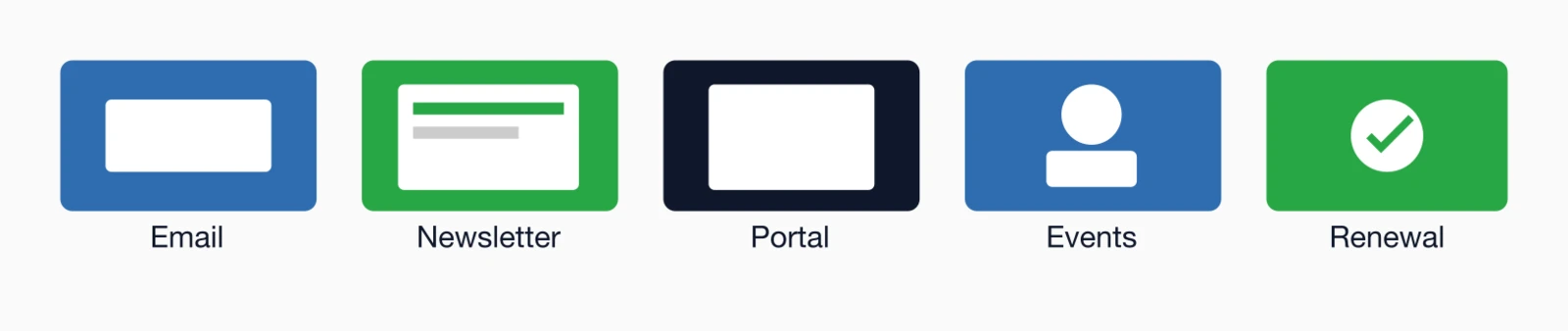

Promoting to members

The launch is just the beginning. Members forget about benefits they don't see regularly, and new members may never know about programs that existed before they joined. Consistent, strategic promotion is what separates high-performing affinity programs from disappointing ones.

Promotion channels

- Email campaigns: Regular "Member Benefits Spotlight" features

- Newsletter sections: Dedicated benefits section in each issue

- Member portal: Benefits dashboard with savings calculator

- Conference promotion: Benefits booth at events

- Renewal reminders: Highlight benefits when asking for renewal

Promotional tactics

- Highlight total potential savings (e.g., "Members save an average of $1,200/year")

- Feature testimonials from members who've used benefits

- Create urgency with limited-time enhanced offers

- Segment promotions by member type and needs

- Use concrete examples of savings ("Save $300 on your next car rental")

Timing considerations

- Insurance open enrollment periods

- Tax season for financial services

- Conference travel for hotel and car rental

- Year-end for business supply purchases

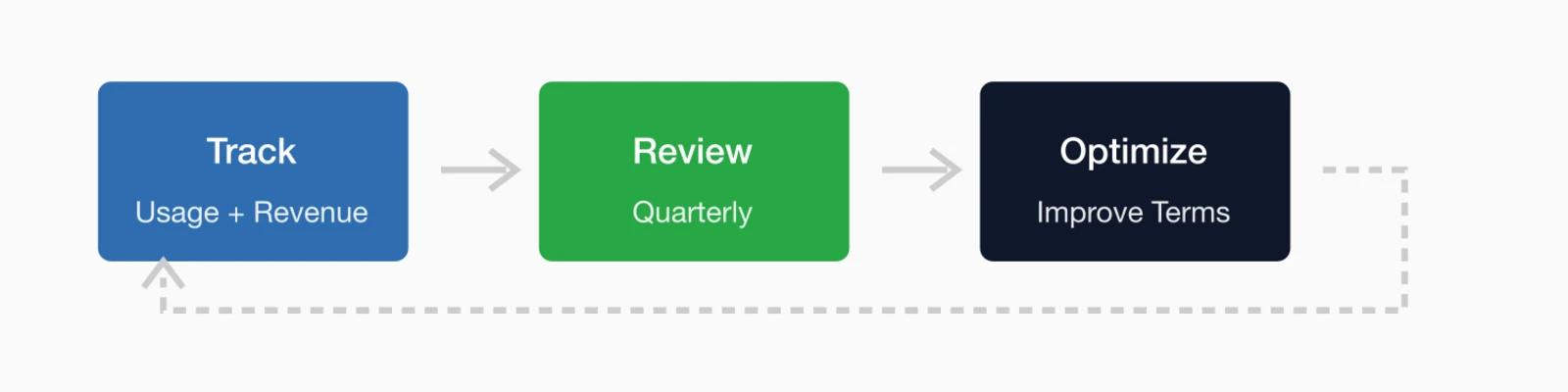

Ongoing management

Affinity programs are not "set it and forget it" revenue streams. They require ongoing attention to maximize value, maintain member trust, and ensure partners continue to deliver on their promises. Regular review helps you identify both problems and opportunities.

Regular review activities

- Quarterly performance review: Track participation, revenue, and member feedback

- Annual partner assessment: Evaluate each partnership for renewal

- Competitive analysis: Ensure discounts remain competitive

- Member satisfaction: Survey members on benefit value and experience

Performance metrics

- Participation rate (% of members using each benefit)

- Revenue generated per benefit

- Member savings reported

- Partner customer service ratings

- Renewal rates for benefit users vs. non-users

When to end partnerships

Consider terminating partnerships that:

- Generate minimal member participation

- Receive consistent member complaints

- No longer offer competitive value

- Require excessive administrative effort

- Don't align with your association's mission or values

Quality over quantity: A curated list of 5-10 excellent benefits is more valuable than 50 mediocre ones. Members trust recommendations when you're selective. Too many options create confusion and dilute the value proposition.

Build member-centric partnerships

Affinity programs work best when you start with member needs, not revenue targets. Focus on partnerships that genuinely help your members save money or access better services, and the revenue will follow.

Key takeaways:

- Prioritize insurance and financial services for highest revenue potential

- Focus on industry-relevant benefits over generic discount programs

- Vet partners carefully—your reputation is on the line

- Promote benefits consistently, not just at launch

- Track participation and be willing to end underperforming partnerships

- Highlight benefits during membership renewal to demonstrate value

For more non-dues revenue strategies, explore our complete Non-Dues Revenue Guide or learn about related opportunities like sponsorship packages and job board revenue.

Key takeaways

- Win-win-win model: Members save money, partners gain customers, you earn revenue

- Insurance is the biggest opportunity: Group health, liability, and professional insurance generate significant commissions

- Focus on relevance: Industry-specific benefits outperform generic discount programs

- Passive revenue potential: Well-established programs generate ongoing income with minimal maintenance

- Membership value driver: Tangible savings strengthen the membership value proposition

Ready to Strengthen Your Member Value Proposition?

i4a's association management platform helps associations deliver and communicate member benefits that drive engagement and retention.

See How i4a Can HelpRelated resources

10 Non-Dues Revenue Ideas for Associations

Complete guide to diversifying your association's revenue streams.

Sponsorship Packages for Associations

Design tiered sponsorship programs that attract corporate partners.

Association Online Store Guide

Generate revenue from branded merchandise and products.

Ensure members know about and use their benefits effectively.