Quick Summary: Member Satisfaction Surveys

- Renewal intent beats NPS for prediction: "How likely are you to renew?" is the single most predictive question—low scores demand immediate personal outreach, not data analysis.

- Keep surveys short: Annual surveys should max out at 10-15 questions (10 minutes); pulse surveys at 3-5 questions (2 minutes). Completion drops after 15 minutes.

- NPS benchmarks for associations: 70+ is excellent, 50-69 is good, 30-49 needs investigation, below 30 requires urgent action.

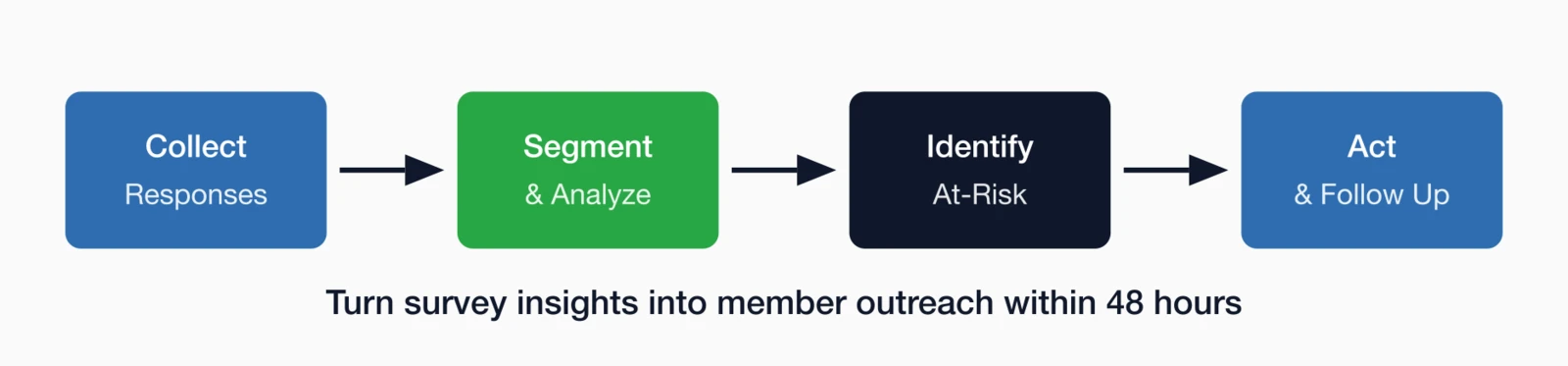

- Act on responses within 48 hours: Detractors and members unlikely to renew should receive personal calls the same day—waiting for full analysis loses the save opportunity.

- Integrate surveys with your AMS: Standalone survey tools create data silos; responses connected to member records enable automated follow-up and retention correlation.

Part of our retention best practices guide

Member satisfaction survey questions should predict renewal, not just measure happiness. This guide includes NPS benchmarks for associations, the one question that best predicts who will lapse, and templates you can use today.

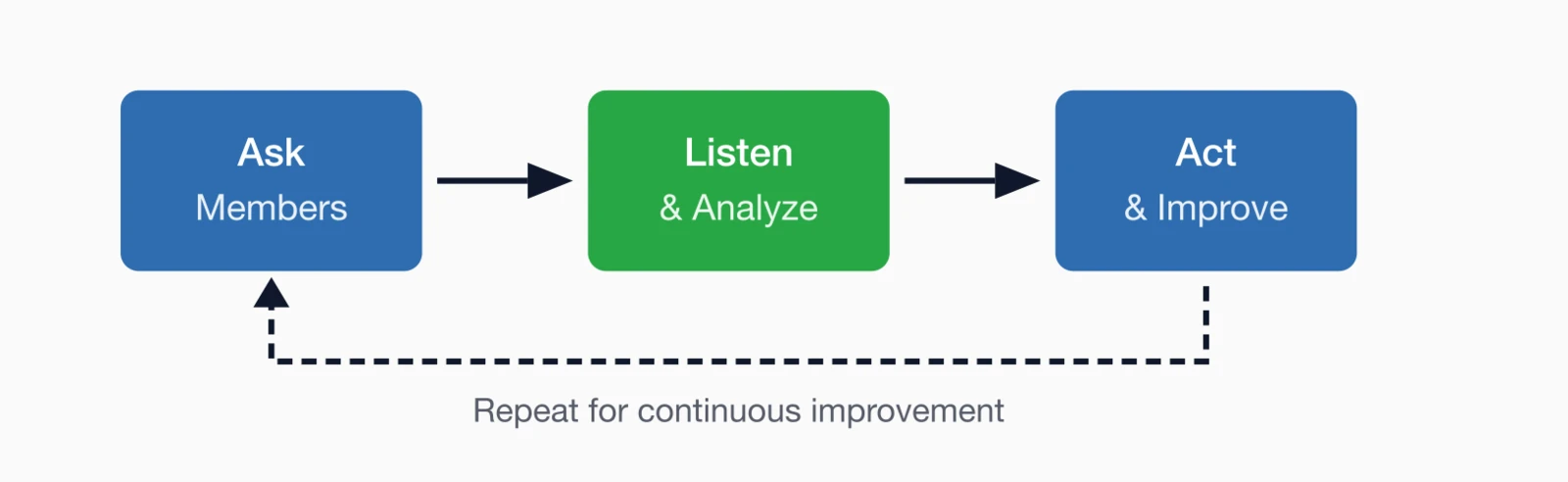

Most associations survey their members. Far fewer get actionable insights that actually improve retention. The difference isn't just what you ask — it's how you ask it and what you do with the answers. Professional associations, trade associations, and membership nonprofits

Here's the uncomfortable truth: Most association surveys are performative. They're sent because "we're supposed to survey members," but the results sit in a PDF that nobody reads. Three months later, nobody can remember what members said. I've seen associations run the same survey for five years straight with no changes based on feedback — and then wonder why response rates keep dropping.

If you're going to ask members for their time, you'd better do something with what they tell you. This guide provides proven survey questions, strategic frameworks, and practical tips for gathering member feedback that drives real improvement in satisfaction and retention.

Why member surveys matter for retention

Regular member feedback serves multiple critical functions, from early warning systems to understanding what members actually value. Done right, surveys don't just gather data—they strengthen the member relationship.

- Early warning system: Dissatisfied members often express concerns in surveys before they vote with their feet. See our guide on identifying at-risk members for more signals.

- Value validation: Understand which benefits members actually use and value

- Gap identification: Reveal unmet needs that could become new programs or services

- Streamlined collection: An integrated survey builder makes creating and distributing surveys simple

- Trend tracking: Monitor satisfaction over time to catch declining sentiment early

- Segment insights: Understand how different member groups experience your association

Research shows that members who are surveyed are more likely to renew — the act of asking for feedback itself signals that you value their input.

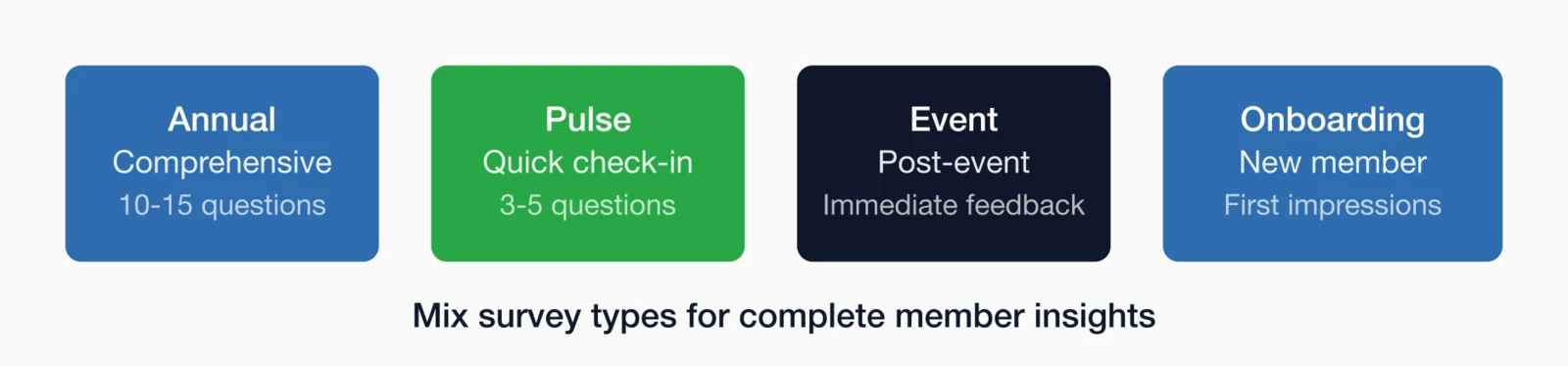

Types of member surveys

Different survey types serve different purposes, and the best survey programs use multiple formats throughout the year to capture different kinds of feedback at the right moments.

Annual comprehensive survey

Your flagship survey, typically 10-15 questions covering overall satisfaction, benefit usage, and strategic priorities. Send once per year, ideally 2-3 months before budget planning so results can inform decisions. Include NPS, renewal intent, and open-ended questions about improvements.

Pulse surveys

Quick 3-5 question check-ins sent quarterly or after major initiatives. Focus on specific topics: "How satisfied are you with our new website?" or "Did you find last month's webinar valuable?" Pulse surveys maintain engagement without survey fatigue and catch issues between annual surveys.

Event feedback surveys

Send within 24-48 hours of an event while the experience is fresh. Ask about session quality, logistics, networking value, and likelihood to attend future events. These inform programming decisions and help identify your most engaged members.

New member onboarding surveys

Survey new members 60-75 days after joining to understand their first impressions and early challenges. Ask what prompted them to join, whether they've found expected benefits, and what would make their membership more valuable. Early feedback prevents first-year churn. See our new member onboarding guide

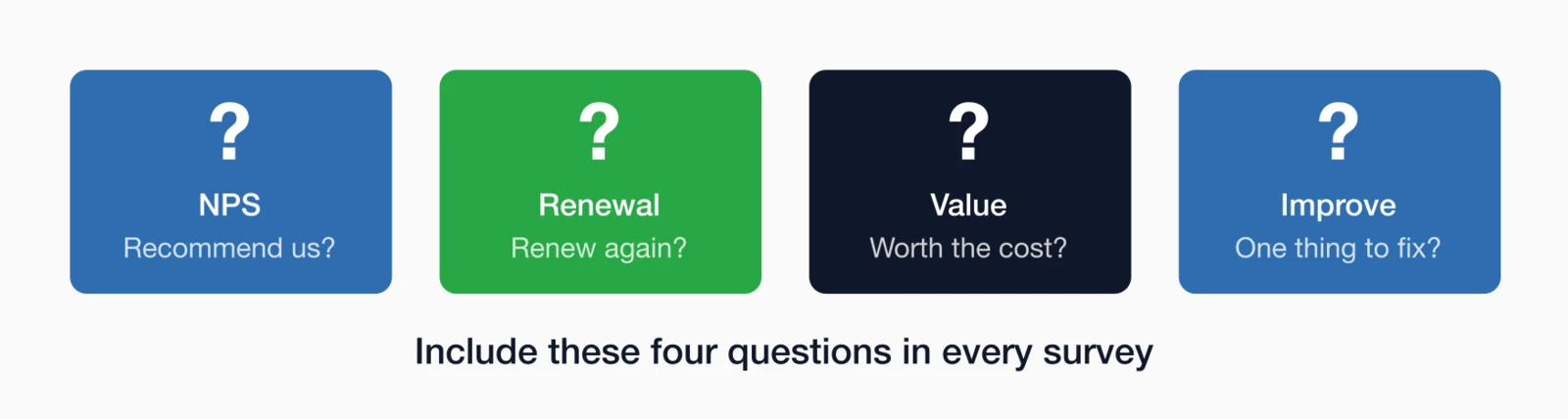

Essential survey questions

While specific questions depend on your association and goals, certain questions are worth including in every member survey. These foundational questions give you consistent data you can track over time.

The net promoter score (NPS) question

"On a scale of 0-10, how likely are you to recommend membership in [Association] to a colleague or peer?"

This single question has proven to be one of the strongest predictors of retention and organizational health.

The renewal intent question

"How likely are you to renew your membership when it expires?"

Direct and highly predictive. Members who answer "somewhat unlikely" or "very unlikely" should be flagged for immediate outreach.

The value question

"How would you rate the overall value of your membership compared to the cost?"

Value perception is the fundamental driver of renewal decisions.

The open-ended improvement question

"What one thing could we do to improve your membership experience?"

This often reveals insights that scaled questions miss entirely.

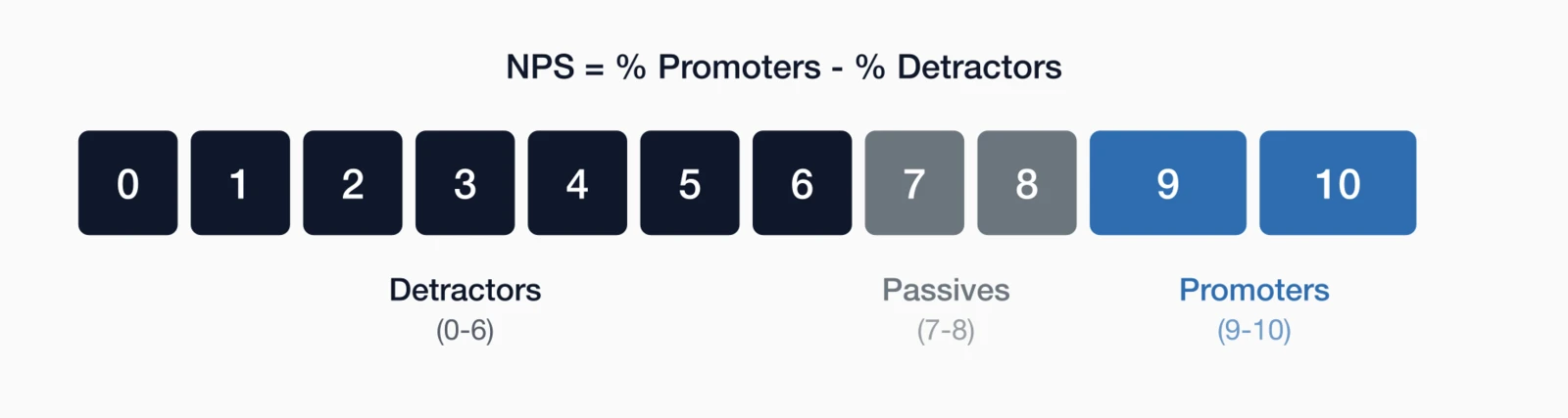

Using net promoter score (NPS)

NPS benchmarks for associations

| NPS Score | Rating | What It Means |

|---|---|---|

| 70+ | Excellent | Top-tier member satisfaction; strong advocacy |

| 50-69 | Good | Healthy organization; room for improvement |

| 30-49 | Moderate | Average; significant opportunity to improve |

| 0-29 | Needs Work | Warning sign; investigate causes |

| Below 0 | Critical | More detractors than promoters; urgent action needed |

Pro Tip: Always follow up the NPS question with "What's the primary reason for your score?" This open-ended question reveals the "why" behind the number.

NPS Calculator

Calculate your Net Promoter Score from survey responses:

This is a "Moderate" score — healthy but with room for improvement.

Real Talk: The One Question That Actually Predicts Renewal

We consistently see associations obsess over NPS while ignoring the question that's actually more predictive: "How likely are you to renew your membership?"

NPS measures advocacy — would they recommend you? But some members are happy to recommend without renewing themselves. The renewal intent question goes straight to the behavior you care about. Ask both, but if someone says they're "unlikely to renew," that's a phone call, not a data point.

Complete question templates

Overall satisfaction questions

- How satisfied are you with your membership overall? (Very dissatisfied → Very satisfied)

- How well does [Association] meet your professional needs? (Not at all → Completely)

- Compared to last year, is your satisfaction with membership: (Much lower → Much higher)

Benefit evaluation questions

- How valuable do you find each of the following benefits? (List benefits with scale)

- Which member benefits have you used in the past 12 months? (Checklist)

- Which benefits would you most want us to improve or expand?

Engagement and communication questions

- How often do you engage with [Association] content (emails, publications, website)?

- How would you rate the quality of our communications?

- Are you receiving too much, too little, or the right amount of communication from us?

Event and programming questions

- How satisfied are you with the quality of our events and programs?

- What topics would you like to see addressed in future programming?

- What prevents you from attending more events? (If applicable)

Open-ended questions

- What do you value most about your membership?

- What one thing could we do to improve your experience?

- Is there anything you expected from membership that you haven't received?

- What would make you more likely to recommend us to colleagues?

Survey design best practices

Keep it short

Survey fatigue is real. For annual surveys, aim for 10-15 questions (10 minutes maximum). For pulse surveys, 3-5 questions (2 minutes). Completion rates drop dramatically after 15 minutes.

Use consistent scales

Pick a scale and stick with it. Switching between 5-point, 7-point, and 10-point scales confuses respondents and complicates analysis.

Balance question types

Effective surveys mix different question formats

- Scaled questions: Easy to answer, easy to track over time

- Multiple choice: Good for specific behavior questions

- Open-ended: 2-3 maximum; place at end

Avoid leading questions

The way you phrase questions shapes the answers you get. Neutral wording

Bad: "How much do you love our excellent networking events?"

Good: "How would you rate the quality of our networking events?"

Make it mobile-friendly

40-50% of survey responses now come from mobile devices. Ensure your survey tool renders properly on phones.

Craft effective survey invitations

The best survey questions won't help if members don't open the email. See our member survey email templates

Test before sending

Send to a small group of staff or volunteer leaders first. Catch confusing questions before they reach your full membership.

Turning data into action

Survey data is only valuable if you act on it. The associations with the best retention rates aren't necessarily the ones with the best survey questions—they're the ones with the best systems for turning feedback into improvement.

Segment analysis

Don't just look at aggregate scores. Break down by member type, tenure, engagement level, and demographics. Different segments often have very different needs.

Trend tracking

Compare results year-over-year. A single score is a snapshot; the trend tells you whether you're improving.

Connect to member records

Integrate survey responses with your membership database

Close the loop

Share results with members. When you make changes based on feedback, communicate that explicitly: "You told us X, so we're doing Y." This demonstrates that surveys lead to action.

Immediate follow-up for at-risk responses

Members who indicate low likelihood to renew or express significant dissatisfaction should be contacted personally within 48 hours. Don't wait for the survey analysis to be complete.

Going Deeper: Closing the Survey-to-Action Gap

Most associations fail not in asking questions, but in acting on answers. Here's a framework for turning survey data into retention action:

| Response Signal | Action Required | Timeline |

|---|---|---|

| NPS 0-6 (Detractor) | Personal call from staff or leader | Within 48 hours |

| "Unlikely to renew" | Escalate to membership director | Same day |

| Specific complaint | Acknowledge + resolution path | Within 1 week |

| Benefit suggestion | Capture for program planning | Quarterly review |

| NPS 9-10 (Promoter) | Thank + invite to refer/volunteer | Within 2 weeks |

The associations with the highest retention rates don't just survey — they have automated workflows that trigger specific actions based on survey responses.

The Survey Data Silo Problem

Here's what breaks most association survey programs: the survey tool doesn't talk to the AMS. You know a member is a detractor, but that information lives in a standalone survey platform, not in their member record.

When survey responses aren't connected to member records, you can't:

- Trigger automated follow-up based on responses

- Factor survey feedback into at-risk member identification

- Correlate satisfaction with renewal behavior

- Personalize communications based on feedback

Getting started

If you're new to member surveying or want to improve your approach:

- Start with a pulse survey: 3-5 questions including NPS and renewal intent

- Establish your baseline: Your first survey sets the benchmark for future comparison

- Commit to regularity: Annual comprehensive + quarterly pulse is a common cadence

- Act visibly: Make at least one visible change based on feedback, then communicate it

- Iterate: Refine questions each cycle based on what you learn

For more strategies on member retention, see our comprehensive Membership Retention Strategy Guide

Interested in improving your member feedback process? Let's talk

Key takeaways

- Keep surveys short — 10-15 questions max for annual surveys, 3-5 for pulse surveys

- Use Net Promoter Score (NPS) as your primary satisfaction benchmark

- Balance quantitative and qualitative: Scales for tracking, open-ended for insights

- Ask about renewal intent — it's the most predictive question for retention

- Act on results: Survey data in your AMS enables targeted follow-up

Make Member Surveys Easy

i4a's association management software includes built-in survey tools that integrate directly with your membership database—create, send, and analyze member feedback all from one platform.

Learn About Survey FeaturesRelated resources

Create and distribute member surveys with built-in access controls.

Complete 2026 strategy guide for improving retention.

Early warning signs of member churn.

10 proven strategies to reduce member churn.