Quick Summary: Survey Emails

- Plan for multiple touches: Most responses come from reminders, not the initial invitation—send 2–3 reminders to non-responders.

- Include time estimate: "5-minute survey" sets expectations and reduces abandonment; be honest about length.

- Only remind non-responders: Sending reminders to people who already completed damages trust and annoys members.

- Close the loop: Share results and actions taken—this dramatically improves future response rates.

- Time it right: Tuesday–Thursday mid-morning or early afternoon outperforms Monday, Friday, and weekends.

Part of our association email communications guide

Member survey emails determine whether you get low response rates or strong participation. The difference isn't your survey questions—it's your invitation strategy, reminder sequence, and subject lines. Here's how to craft survey invitations that actually get completed.

Survey invitations are the unsung hero of member feedback. You can design the perfect survey with brilliant questions, but if no one takes it, you've wasted everyone's time. I've watched associations send a single survey invitation to their entire list, get disappointing response rates, and wonder why their data isn't representative. Meanwhile, associations using strategic invitation sequences consistently see much higher participation—and the difference is entirely in how they ask.

This guide covers the email strategies that boost survey participation: the invitation structure, reminder cadence, subject line approaches, and follow-up that ensures members not only complete your survey but remain willing to participate in future research.

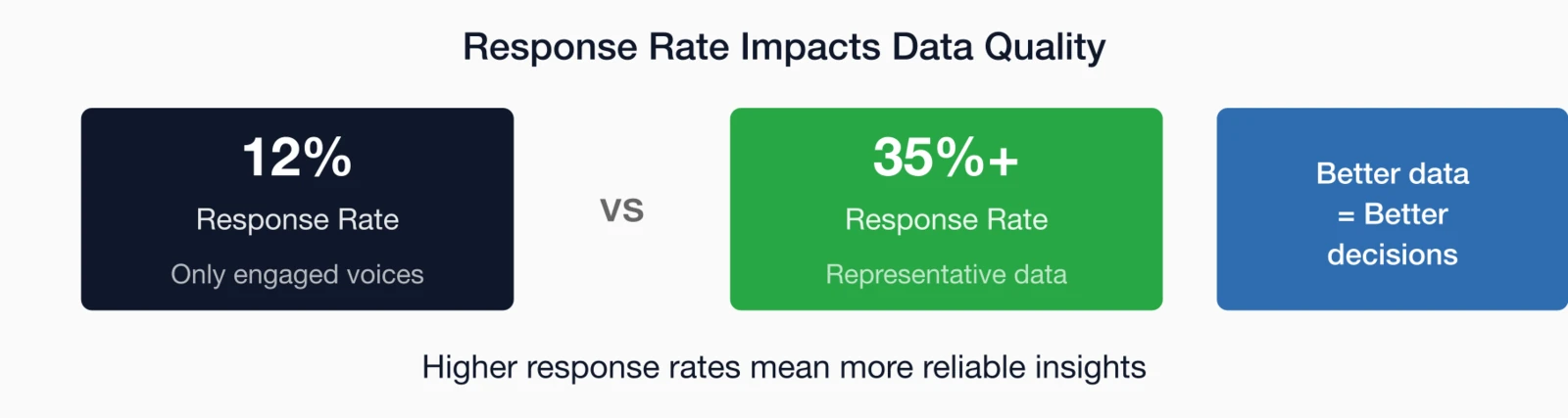

Why response rates matter

Response rate isn't just a vanity metric—it directly affects whether your survey data is useful. A beautifully designed survey with a low response rate tells you what your most engaged members think, not what your membership thinks. Understanding this distinction is the first step toward gathering feedback you can actually trust.

- Representativeness: Low response rates mean you're hearing from a self-selected subset—usually your most engaged members. You may miss important perspectives from less-engaged segments.

- Statistical confidence: Larger samples allow more reliable conclusions and smaller subgroup analysis.

- Decision quality: Better data leads to better decisions. Half your members feeling unheard is different from 90% feeling unheard.

Example response rate targets

Response rates vary widely based on audience, survey length, and how well you communicate. Here are example targets to help you set expectations:

| Survey Type | Typical | Good | Excellent |

|---|---|---|---|

| Annual member survey | 15-20% | 25-35% | 40%+ |

| Event evaluation | 20-25% | 35-45% | 50%+ |

| Quick pulse survey (3-5 questions) | 25-30% | 40-50% | 55%+ |

| Exit/non-renewal survey | 10-15% | 20-25% | 30%+ |

Your mileage will vary, but with better invitation emails, you can typically improve your response rates without changing anything about the survey itself.

The initial invitation

Your initial invitation does the heavy lifting—it sets expectations, establishes credibility, and determines whether members even consider participating. Get this right, and reminder emails become reinforcement rather than rescue attempts.

Essential elements

- Clear purpose: Why are you asking? What will you do with the data?

- Time estimate: How long will it take? Be honest—overestimating is worse than underestimating

- Deadline: When does the survey close? Creates urgency

- Why their input matters: Connect to outcomes they care about

- Easy access: Direct link to the survey, prominently placed

- Privacy/confidentiality: Brief note on how responses will be used

Template: Annual member survey

Subject: Your voice matters: 2026 Member Survey (5 minutes)

Body:

Hi [First Name],

We want to hear from you.

Each year, we survey members to understand what's working, what isn't, and what you need from [Association Name]. Your feedback directly shapes our programs, resources, and priorities for the coming year.

The survey takes about 5 minutes. It covers your satisfaction with current benefits, your priorities for the future, and how we can better serve members like you.

[START SURVEY button]

Survey closes [Date].

Your responses are confidential—we report only aggregate results, and your individual answers are never shared.

Thank you for helping us improve.

[Signature]

P.S. Last year's survey led directly to [specific improvement]. Your input makes a real difference.

The P.S. Power: Postscripts get read, even when the rest of the email is skimmed. Use the P.S. to show that past surveys led to actual change. This is powerful motivation—members are more likely to participate when they believe their feedback matters.

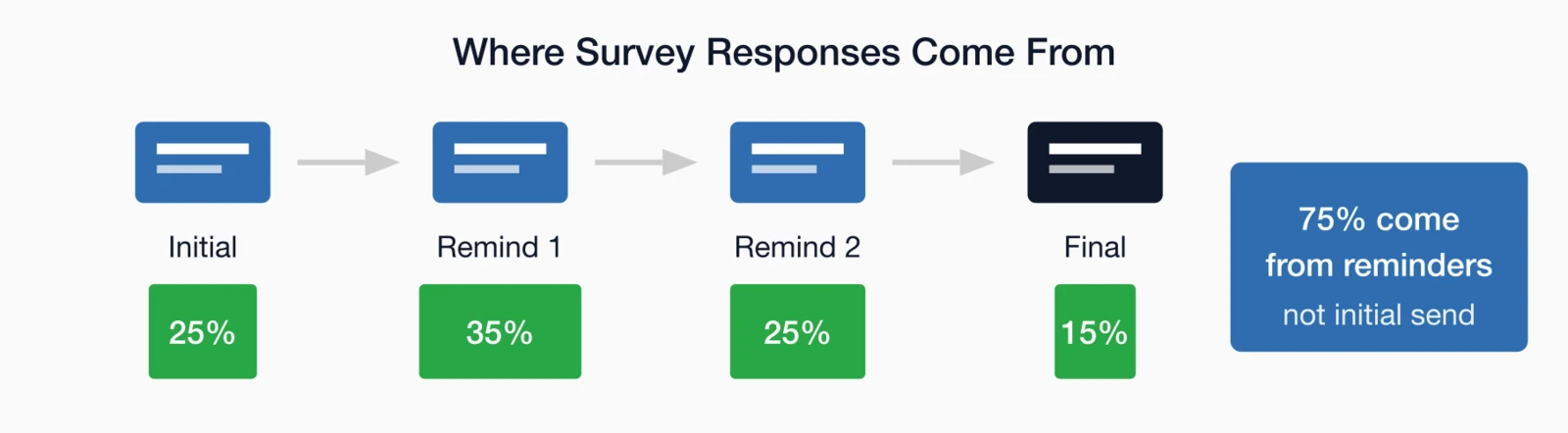

Reminder email sequence

Here's a truth that surprises many association professionals: most survey responses come from reminder emails, not the initial invitation. The members who respond immediately are your super-engaged loyalists. Everyone else needs a nudge—or two, or three. Plan for 2-3 reminders to non-responders.

Reminder timing

- Reminder 1: 3-4 days after initial invitation

- Reminder 2: 7-8 days after initial (3-4 days before deadline)

- Final reminder: Day before or day of deadline

Critical: Only send reminders to non-responders. Sending reminders to people who already completed the survey is annoying and damages trust. A good survey tool tracks completions and allows you to suppress them from reminder sends automatically.

Template: First reminder

Subject: Quick reminder: Member survey closes [Date]

Body:

Hi [First Name],

We haven't heard from you yet, and we'd hate to miss your input.

The 2026 Member Survey takes about 5 minutes and helps us understand how to serve you better.

[TAKE THE SURVEY button]

Survey closes [Date]. We've already heard from [X] members, and your voice would add to that picture.

Thank you,

[Signature]

Template: Final reminder

Subject: Last chance: Survey closes tonight

Body:

Hi [First Name],

The member survey closes at midnight tonight. This is your last chance to share your feedback.

Even if you only have a few minutes, we'd value your perspective on [specific question or topic].

[TAKE THE SURVEY button]

Thank you to the [X] members who have already responded. If you haven't yet, we hope you'll join them.

[Signature]

Subject line strategies

Subject lines determine whether your survey invitation gets opened at all. A great survey behind a weak subject line is invisible. The good news: you can test different approaches systematically to find what resonates with your specific audience.

Effective subject line patterns

| Approach | Examples |

|---|---|

| Time estimate | "5 minutes to shape [Association]'s future" "Quick survey: 3 questions, 2 minutes" |

| Impact statement | "Your input drives our priorities" "Help us improve [specific benefit]" |

| Personal ask | "[First Name], we need your opinion" "Can we ask you a few questions?" |

| Urgency | "Survey closes Friday—share your voice" "Last day: Member feedback survey" |

| Direct/simple | "2026 Member Survey" "Your annual member survey" |

What to avoid

- Vague subjects: "We want to hear from you" (hear about what?)

- All caps or excessive punctuation: "IMPORTANT SURVEY!!!"

- Misleading urgency: "Urgent" when it's not

- No mention of survey: Subject should make clear it's a survey request

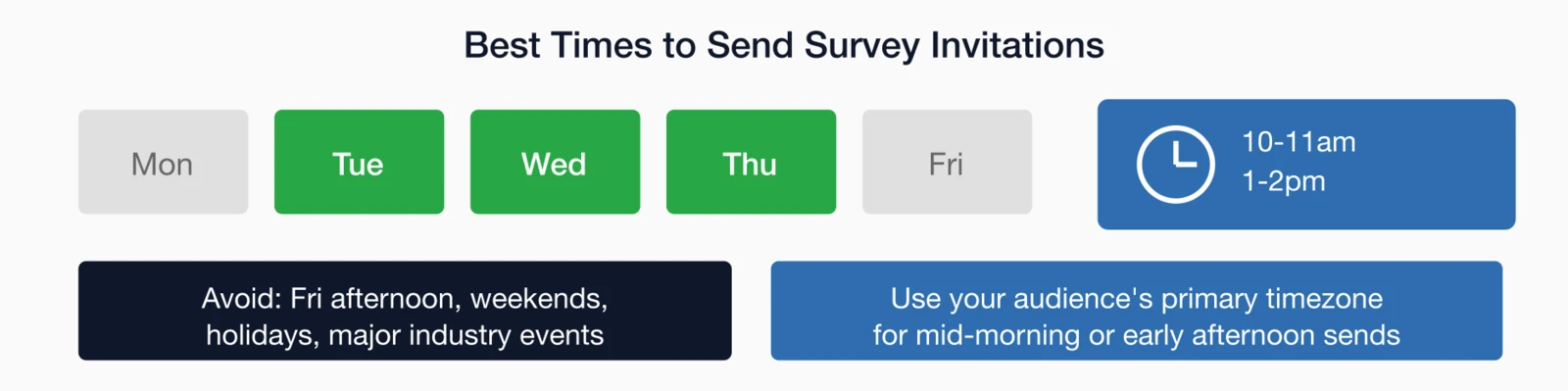

Timing your invitations

When you send survey invitations affects response rates more than most associations realize. The same email sent at different times can see dramatically different open and completion rates. Understanding your audience's patterns—and avoiding common timing mistakes—can boost responses without changing a single word of your invitation.

Best days and times

- Best days: Tuesday, Wednesday, Thursday typically outperform Monday and Friday

- Best times: Mid-morning (10am-11am) or early afternoon (1pm-2pm) in your audience's primary timezone

- Avoid: Friday afternoons, weekends, holidays, and major industry events

Survey duration

Keep surveys open long enough to collect responses but short enough to maintain urgency:

- Short surveys (3-5 questions): 5-7 days

- Medium surveys (10-15 questions): 10-14 days

- Comprehensive surveys (20+ questions): 14-21 days

Longer isn't always better. Extended survey periods often see responses cluster in the first few days and the last day, with little activity in between.

A deeper look: Event survey timing

Event evaluations are time-sensitive. Send them:

- For in-person events: Within 24-48 hours of the event ending, while the experience is fresh

- For virtual events: Immediately after the session ends, or within 24 hours

- For multi-day conferences: Daily pulse surveys during the event + comprehensive survey 1-2 days after

Response rates for event surveys drop significantly each day after the event. A survey sent a week later will get half the responses (or worse) of one sent the next day.

Incentives and thank yous

Should you offer incentives for survey completion? The honest answer: it depends on your goals and audience. Incentives can boost response rates, but they can also attract responses from people who wouldn't otherwise engage—which may or may not be what you want. Here's how to think through this decision.

When incentives help

- Longer surveys (15+ minutes) where completion requires significant effort

- Surveys to non-members or lapsed members who have less inherent motivation

- Research where you need a very high response rate for statistical validity

Incentive options

- Prize drawing: Enter all respondents to win a gift card, free event registration, or other prize

- Guaranteed small incentive: Everyone who completes gets something (e.g., $5 gift card, free resource download)

- Donation in their name: Donate to a cause for each completed survey

When to skip incentives

For engaged members taking short surveys, incentives may not significantly boost response rates. Members who care about the association will participate because they want their voice heard. In these cases, the best "incentive" is showing them their past feedback led to action.

Thank you messaging

Always thank respondents after they complete the survey. This can be:

- An immediate confirmation page after submission

- A follow-up email thanking them and previewing next steps

- Both—confirmation page for immediate gratification, email for record and follow-up

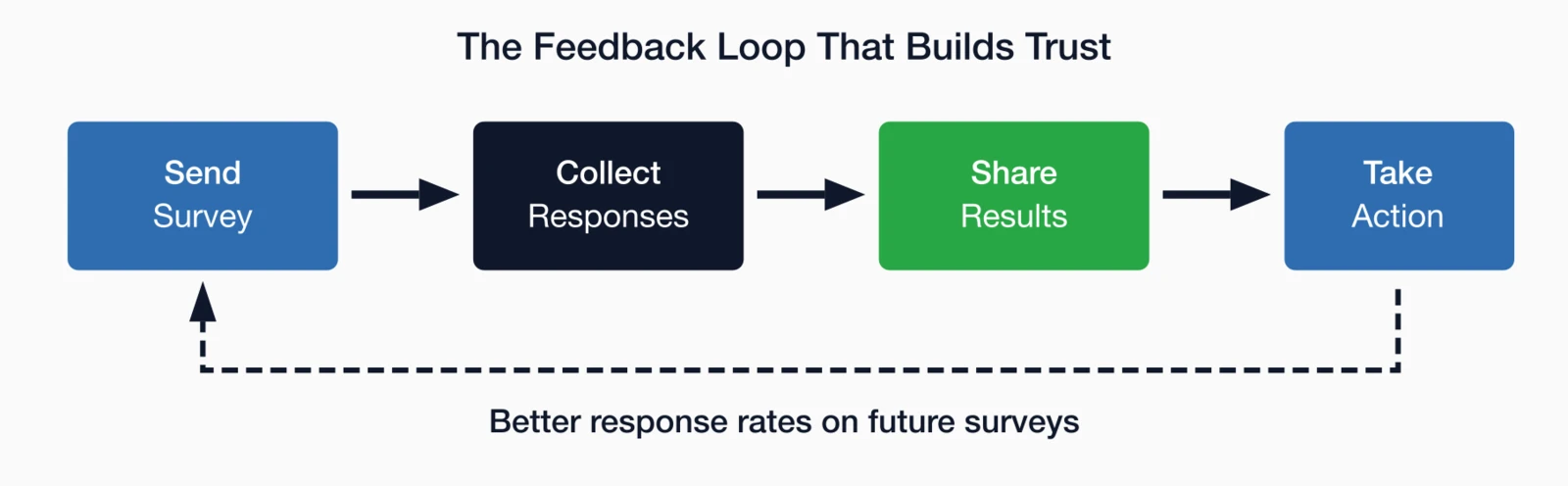

Closing the loop

The most overlooked part of survey communication is what happens after. Many associations treat survey completion as the end of the process, but it's really just the midpoint. Sharing results and actions taken dramatically improves future response rates—and builds member trust that their voice actually matters.

Why closing the loop matters

Members who see their feedback lead to action are more likely to participate in future surveys. Those who never hear back start to believe surveys are pointless—and response rates decline over time.

Template: Results summary email

Subject: What you told us—and what we're doing about it

Body:

Hi [First Name],

Thank you to the [X] members who completed our recent survey. Your feedback is invaluable, and we want to share what we learned and what's changing as a result.

What You Told Us:

- [Key finding 1]

- [Key finding 2]

- [Key finding 3]

What We're Doing:

- [Action 1 in response to feedback]

- [Action 2 in response to feedback]

- [Action 3 in response to feedback]

Your input shapes our direction. Thank you for taking the time to help us improve.

[Link to full results summary, if available]

[Signature]

Be specific: "We're improving based on your feedback" is weak. "You told us networking events needed better structure, so we're adding facilitated introductions at our next event" is powerful. Specific connections between feedback and action build trust.

Templates by survey type

Different survey contexts call for different invitation approaches. Here are templates tailored to the most common association survey scenarios, each designed to address the specific motivations and barriers relevant to that context.

Event evaluation survey

Subject: How was [Event Name]? (2-minute feedback)

Body:

Hi [First Name],

Thank you for attending [Event Name]! We hope you found it valuable.

Would you take 2 minutes to share your feedback? Your input directly shapes future events.

[SHARE FEEDBACK button]

Thank you,

[Signature]

Non-renewal exit survey

Subject: We'd like to understand: quick feedback on your membership

Body:

Hi [First Name],

We noticed you haven't renewed your [Association Name] membership, and we'd like to understand why.

Would you take 3 minutes to share your feedback? Your candid input helps us improve for current and future members.

[SHARE FEEDBACK button]

If there's anything we can do to address your concerns, please let us know. We value the time you spent with us.

[Signature]

Quick pulse survey

Subject: One quick question about [Topic]

Body:

Hi [First Name],

We're making a decision about [topic] and want member input.

Quick question: [Question]

[Answer option buttons embedded in email, if possible, or link to single-question survey]

That's it—just one question. Thank you for helping us make better decisions.

[Signature]

Get the feedback you need

Survey response rates aren't fixed—they're the result of how you ask. Use clear invitations, strategic reminders, and thoughtful follow-up. Show members their feedback matters by closing the loop with results and actions.

The associations that excel at member research aren't the ones with the fanciest survey tools. They're the ones who've mastered the art of asking—through invitation emails that respect members' time, explain why participation matters, and demonstrate that feedback leads to real change.

For more on member communications, explore our Association Email Marketing Guide or learn about email segmentation strategies for targeted survey invitations.

Key takeaways

- Plan for 3-4 touchpoints: Initial invitation plus 2-3 reminders to non-responders

- Tell them how long it takes: "5-minute survey" sets expectations and reduces abandonment

- Explain why it matters: Connect the survey to benefits they'll experience

- Close the loop: Share results and actions taken—it dramatically improves future response rates

Collect Better Member Feedback

i4a's integrated Survey Builder lets you target surveys to specific member segments and track who's responded—so reminders only go to those who haven't completed the survey.

Explore Survey BuilderRelated resources

Target surveys to the right member groups for better response rates.

Understand what good email performance looks like.

Complete strategy guide for association email marketing.

Best practices for member satisfaction survey questions.