Quick Summary: Payment Processing

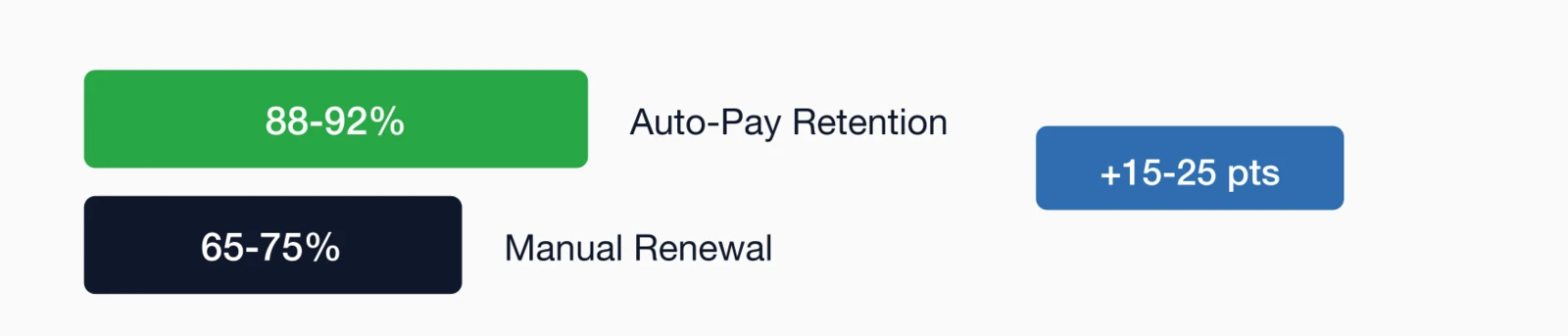

- Auto-pay transforms retention: Members enrolled in automatic renewal renew at 88–92% vs. 65–75% for manual payers.

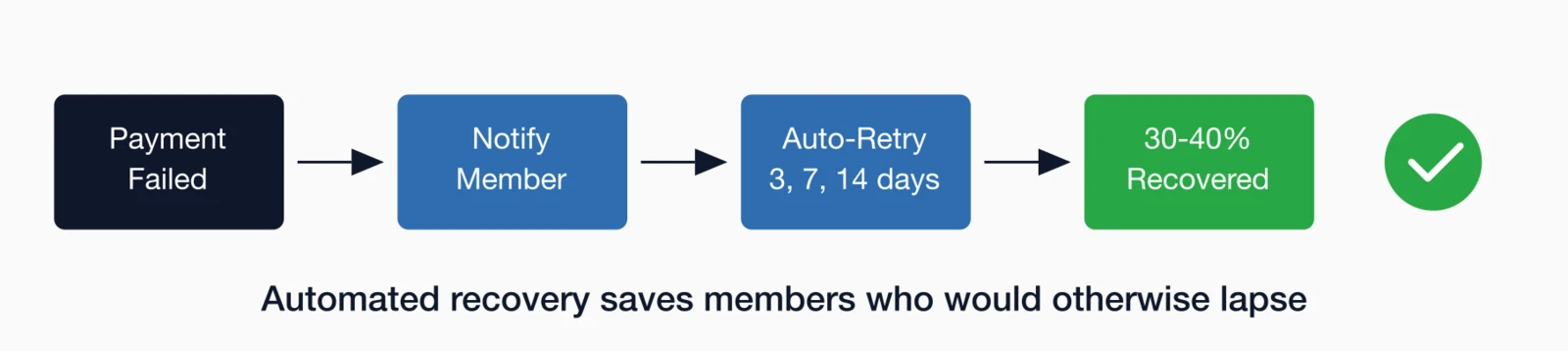

- Failed payment recovery matters: Automated retry sequences recapture 30–40% of initially failed transactions.

- ACH cuts costs significantly: eCheck processing costs 50–75% less than credit cards—ideal for recurring dues.

- Saved payments reduce friction: One-click checkout lowers abandonment rates by 30–40% on renewals and registrations.

- Target 40–50% auto-pay enrollment: This creates a stable renewal base while respecting member preferences.

Part of our membership software guide

Payment processing best practices directly impact retention: auto-pay members renew at significantly higher rates than manual payers. Here's how to boost auto-pay enrollment, recover failed payments, and reduce processing costs with ACH.

The difference between a friction-filled payment experience and a seamless one? It's not about spending more money. It's about implementing the right practices. Integrated association payments and accounting tools handle the heavy lifting automatically.

Why payment processing matters

It's easy to think of payment processing as purely transactional—money in, receipt out, done. But in reality, payment processing is one of the most important touchpoints in your member experience, with direct implications for retention, staff efficiency, and your organization's financial health. Every friction point in the payment process creates an opportunity for a member to abandon their renewal or event registration. Here's why payment processing deserves strategic attention:

Member retention

The easier you make it to pay, the more members renew. It sounds obvious, but many associations still create unnecessary friction:

- Requiring members to find a renewal form

- Asking them to re-enter payment information every time

- Limiting payment options

- Slow or confusing checkout processes

Each friction point costs you renewals. We consistently see a strong correlation: associations with modern payment systems have higher retention rates than those with outdated processes.

Staff efficiency

Manual payment processing consumes staff time:

- Keying in credit card numbers from phone calls

- Matching checks to invoices

- Following up on failed payments

- Issuing refunds manually

- Reconciling payments with accounting

Automated payment systems handle these tasks in the background, freeing staff for member-facing work.

Cash flow

Payment timing affects your association's cash flow:

- Real-time credit card processing vs. waiting for checks

- Auto-pay providing predictable monthly revenue

- Installment plans spreading large payments over time

- Faster failed payment recovery

Payment method options

One-size-fits-all payment processing leaves money on the table. Individual members may prefer credit cards for the convenience and rewards points. Corporate members often require invoicing to match their procurement processes. Members who set up recurring payments tend to prefer ACH for lower fees. By offering multiple payment options, you reduce friction for everyone and increase the likelihood that each transaction completes successfully.

Credit/debit cards

The most common payment method for individual members:

- Pros: Instant processing, familiar to members, supports auto-pay

- Cons: Higher processing fees (2.2-3.5%), card expiration issues

- Best for: Individual memberships, event registrations, online purchases

Accept all major cards: Visa, Mastercard, American Express, Discover.

ACH/eCheck

Direct bank account withdrawal—increasingly popular for recurring payments:

- Pros: Much lower fees (0.5-1.0% or flat fee), no expiration dates, higher success rates

- Cons: Longer processing time (2-3 days), requires bank account info

- Best for: Corporate memberships, recurring dues, large payments

Invoice/check

Still necessary for some corporate and government members:

- Pros: Required by some organizations' procurement processes

- Cons: Slow, requires manual processing, harder to track

- Best for: Large corporate memberships, government agencies

Make invoicing available but encourage electronic payment methods whenever possible.

Auto-pay programs: The retention game-changer

If there's one payment practice that has the biggest impact on retention, it's auto-pay. Members who enroll in automatic renewal renew at dramatically higher rates than those who don't.

The numbers

- Auto-pay retention: 88-92%

- Manual renewal retention: 65-75%

- Difference: 15-25 percentage points higher retention

That's not a marginal improvement—it's transformational. An association with 50% auto-pay enrollment sees dramatically better overall retention than one with 10%.

Implementing auto-pay effectively

1. Make Enrollment Easy:

- Offer auto-pay during initial membership signup

- Promote it during online renewal

- Include signup link in renewal reminder emails

- Allow enrollment through the member portal anytime

2. Be Transparent:

- Clearly explain what auto-pay means

- Show the exact amount that will be charged

- Provide the billing date in advance

- Send reminder 30 days before annual charge

3. Make Opt-Out Simple:

While auto-pay is a retention game-changer, it must be implemented ethically. The Federal Trade Commission warns against "dark patterns" that make cancelling subscriptions difficult. To remain compliant and maintain member trust, your auto-pay program must offer transparent billing notifications and a simple opt-out process:

- Never force auto-pay or make it hard to cancel

- Allow cancellation through the member portal

- Include opt-out instructions in every notification

- Process cancellation requests promptly

Auto-Pay Strategy: We recommend associations set a goal of 40-50% auto-pay enrollment. This provides a stable renewal base while respecting members who prefer manual renewal. Track auto-pay enrollment as a key metric alongside retention rate.

Saved payment methods

Even members who don't use auto-pay benefit from saved payment methods. The ability to renew or register for events with one click removes a major source of checkout friction.

How it works

- Members save a credit card or bank account in their profile

- Payment info is stored securely (tokenized, not in your database)

- At checkout, they select their saved payment method

- One click completes the transaction

Impact on conversion

Saved payment methods reduce checkout abandonment significantly:

- 30-40% fewer abandoned renewals

- Higher event registration completion rates

- More impulse purchases from your online store

- Faster checkout = happier members

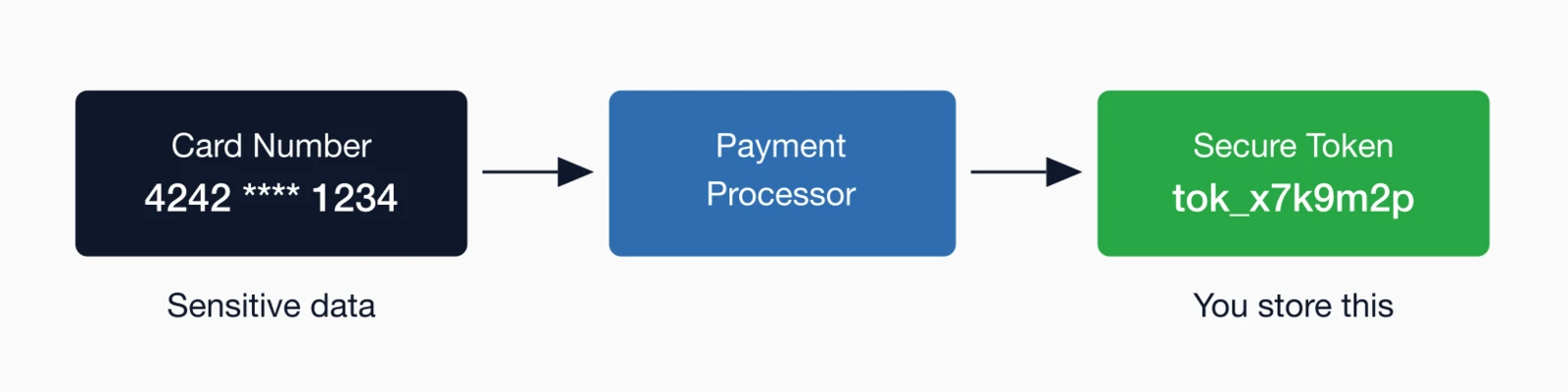

Security considerations

Members rightfully care about payment security. Reassure them:

- Payment info is tokenized—you never see or store full card numbers

- PCI DSS compliance protects their data

- They can remove saved methods anytime

- Strong authentication for accessing payment settings

Failed payment recovery

Not every payment attempt succeeds on the first try. Cards expire, accounts have insufficient funds, banks flag unusual activity. How you handle failed payments directly impacts your renewal rate.

Common failure reasons

- Expired card: Card reached its expiration date

- Insufficient funds: Account doesn't have enough balance

- Bank decline: Issuing bank rejected the transaction

- Fraud prevention: Bank flagged as suspicious

- Closed account: Card or bank account no longer active

Automated recovery process

- Immediate notification: Email member within minutes that payment failed

- Clear instructions: Link directly to update payment method

- Automatic retry: Retry the charge after 3, 7, and 14 days

- Escalation: If retries fail, send more urgent communication

- Grace period: Maintain access during recovery attempts

Recovery rate

With automated retry and proactive member communication, associations typically recover 30-40% of initially failed payments. Without it, most of those members simply lapse.

Installment payment plans

Sticker shock is real. When a member sees a $500 conference registration or $1,000 annual dues payment, their hesitation isn't necessarily about the value—it's about the immediate hit to their budget or credit limit. Installment payment plans solve this problem by breaking large payments into manageable monthly amounts, significantly improving conversion for higher-value transactions while still collecting the full amount over time.

When to offer installments

- Memberships over $300-500: Annual dues feel more manageable as monthly payments

- Conference registrations: $500+ events benefit from payment plans

- Certification programs: Multi-thousand dollar programs almost require installment options

Installment plan structures

- Monthly for 12 months: Split annual dues into 12 equal payments

- Quarterly for 4 payments: Less frequent but still spreads the cost

- 3-6 months for events: Pay off before the event date

Implementation considerations

- Automatic billing: Each installment processes automatically

- Failed payment handling: Same recovery process applies

- Early payoff option: Let members pay the balance anytime

- Clear terms: Members understand the total cost and schedule

Revenue Consideration: Some associations charge a small premium for installment plans (e.g., $420 paid monthly vs. $400 paid upfront) to offset processing costs and incentivize full payment. Others offer it at the same price as a member convenience. Either approach works—just be consistent and transparent.

Managing processing costs

Every time a member swipes a card or submits an ACH payment, there's a transaction fee attached. For associations processing thousands of transactions annually, these fees can add up to tens of thousands of dollars. The good news is that with smart strategies—like negotiating nonprofit rates, encouraging lower-cost payment methods, and minimizing chargebacks—you can significantly reduce these costs without sacrificing the convenient payment experience members expect.

Typical processing costs

| Payment Method | Typical Cost | Example on $200 Dues |

|---|---|---|

| Credit Card (Standard) | 2.9% + $0.30 | $6.10 |

| Credit Card (Nonprofit Rate) | 2.2% + $0.30 | $4.70 |

| ACH/eCheck | 0.8% or $0.50 flat | $1.60 or $0.50 |

| Check (Processing Labor) | ~$5-10 staff time | $5-10 |

Cost reduction strategies

1. Negotiate Nonprofit Rates:

Most payment processors offer reduced rates for 501(c) organizations. Make sure you're on the nonprofit tier.

2. Encourage ACH for Recurring Payments:

ACH costs 50-75% less than credit cards. Promote it for auto-pay enrollments, especially for corporate memberships with higher dues.

3. Consider Flat-Rate vs. Interchange-Plus:

- Flat rate: Simple, predictable (e.g., 2.9% + $0.30 for everything)

- Interchange-plus: Lower for some transactions, more complex to understand

For most associations, flat-rate simplicity wins.

4. Minimize Chargebacks:

- Clear billing descriptors so members recognize charges

- Easy refund process to avoid disputes

- Good communication about billing timing

Security and compliance

When members enter their credit card information on your website, they're trusting you to protect that sensitive data. A security breach doesn't just expose members to fraud—it can devastate your organization's reputation and result in significant legal liability. The good news is that modern payment systems handle most security requirements automatically through tokenization and PCI-compliant processors. Your job is to ensure you're using these tools correctly and staying current with compliance requirements.

PCI DSS compliance

Data security is the foundation of member trust. Associations must adhere to the PCI DSS standards, which require rigorous controls for handling cardholder data. By using a payment processor that utilizes tokenization, you ensure that sensitive card numbers never touch your database—fulfilling a core requirement of PCI compliance:

- Use a compliant payment processor: They handle the heavy lifting

- Never store card numbers: Tokenization replaces card data with secure tokens

- Secure transmission: All payment pages must use HTTPS

- Annual self-assessment: Document your compliance status

Tokenization

Modern payment systems don't store actual card numbers. Instead:

- Card data goes directly to the payment processor

- You receive a "token" that represents the card

- The token can process charges but can't be used elsewhere

- If your database is compromised, no card numbers are exposed

Fraud prevention

- AVS (Address Verification): Matches billing address to card

- CVV required: Requires the 3-4 digit security code

- Velocity limits: Flag multiple failed attempts

- 3D Secure: Additional verification for high-risk transactions

Accounting integration

Nothing frustrates finance staff more than spending hours each month manually matching payment deposits to invoices and member records. When your payment processing isn't integrated with your accounting system, you create opportunities for errors, duplicate entries, and reconciliation headaches. Modern integration between your AMS and accounting software eliminates most of this manual work, ensuring that payment data flows accurately into the right accounts with the right coding.

Essential integration points

- Revenue recognition: Dues revenue posts automatically with proper coding

- Deferred revenue: Annual memberships recognized over 12 months

- Payment matching: Deposits reconcile with individual transactions

- Refund tracking: Refunds post correctly as negative revenue

QuickBooks integration

Most associations use QuickBooks or similar accounting software. Look for:

- Automatic daily sync of transactions

- Mapping to your chart of accounts

- Proper handling of sales tax if applicable

- Invoice creation and payment matching

Integration eliminates month-end reconciliation headaches and gives finance staff accurate, real-time data. Learn more about how i4a's association management platform handles financial integration.

Implementation checklist

Optimizing payment processing can feel overwhelming when you look at everything at once. The key is to prioritize the highest-impact improvements first—typically auto-pay programs and failed payment recovery—then work through the supporting infrastructure systematically. Here's a checklist to guide your implementation, organized by category:

Payment method foundation

- Accept all major credit cards (Visa, MC, Amex, Discover)

- Enable ACH/eCheck payments

- Offer invoicing for corporate/government members

- Ensure nonprofit processing rates are applied

Member convenience features

- Enable saved payment methods with secure tokenization

- Launch auto-pay program with clear opt-in/opt-out

- Implement one-click renewal for returning members

- Offer installment plans for high-value transactions

Failure recovery

- Set up automated failed payment notifications

- Configure automatic retry schedule (3, 7, 14 days)

- Create easy payment update process

- Establish grace period during recovery

Backend operations

- Connect to accounting system (QuickBooks, etc.)

- Configure proper GL account mapping

- Set up deferred revenue handling

- Create reconciliation reports

Security and compliance

- Verify PCI DSS compliance

- Enable tokenization (never store card numbers)

- Activate fraud prevention features

- Complete annual self-assessment questionnaire

Conclusion: Payments as a retention strategy

Payment processing is often treated as a back-office function—something that just needs to work. But the associations I've seen achieve the highest retention rates treat payments as part of their member experience strategy.

Every time you make it easier to pay, you remove a barrier to renewal. Every failed payment you recover is a member saved. Every auto-pay enrollment is a future renewal locked in.

The best part? These improvements aren't expensive. They're configuration and process changes that pay for themselves through higher retention and lower staff time on payment chasing.

Key takeaways

- Auto-pay members retain at 88-92% vs. 65-75% for manual renewers

- Saved payment methods reduce checkout abandonment by 30-40%

- Failed payment recovery can recapture 30-40% of initially failed transactions

- ACH/eCheck costs 50-75% less than credit card processing

- Installment plans increase conversion for high-value memberships by 15-25%

Secure Payment Processing Built In

i4a's AMS software includes built-in payment processing with PCI compliance, fraud protection, and transparent flat-rate pricing—so you can collect payments securely without hidden fees.

Learn About Payment SolutionsRelated resources

Complete guide to automating association operations including payment processing.

Detailed guide to renewal automation including payment automation strategies.

Multi-Association Management for AMCs

How AMCs manage payment processing across multiple clients.

Automating Membership Processes

Complete guide to membership workflow automation.